Yes! You can use AI to fill out Form 1096, Annual Summary and Transmittal of U.S. Information Returns

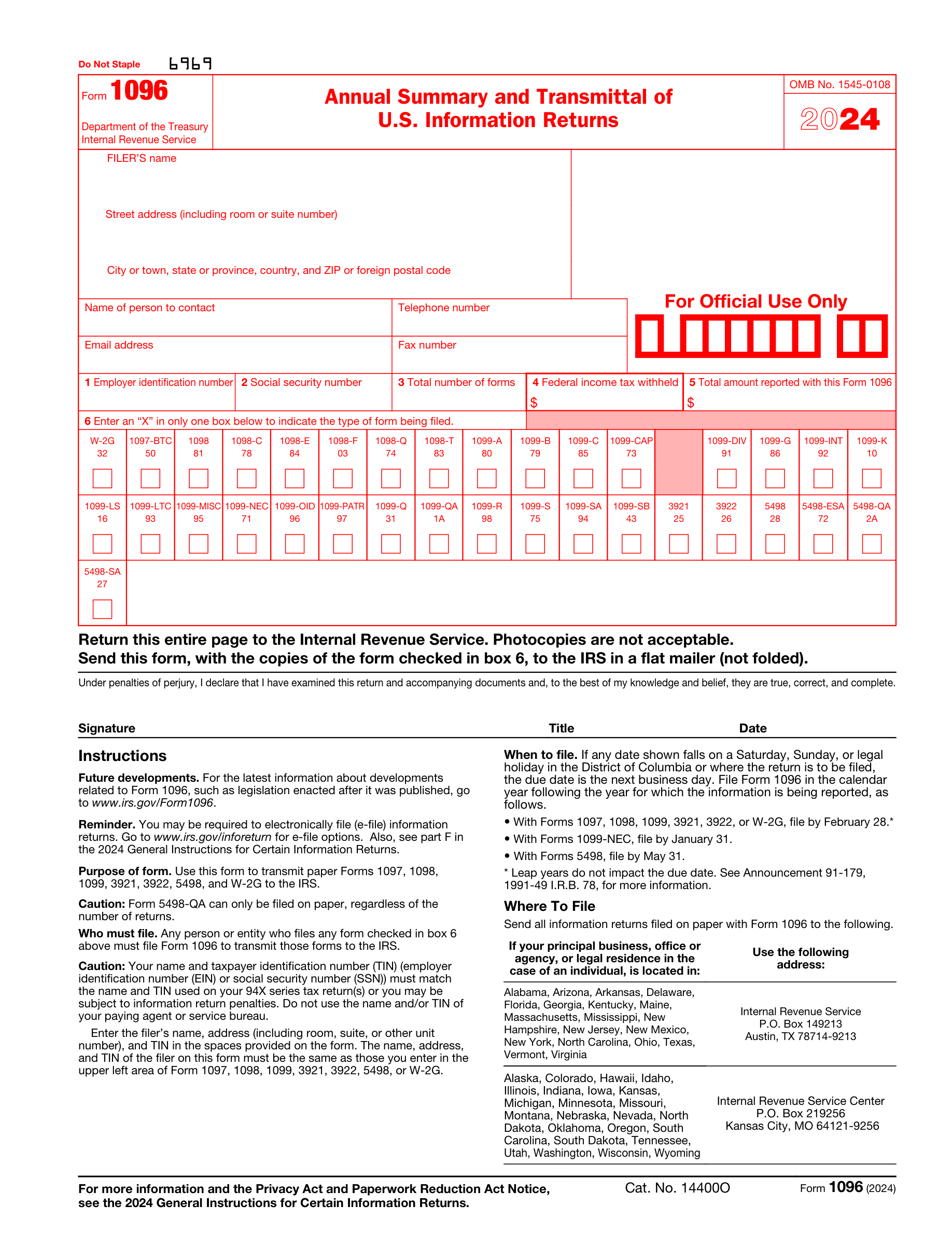

Form 1096, Annual Summary and Transmittal of U.S. Information Returns, is used to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS. It is important to fill out this form correctly to avoid penalties and ensure compliance with IRS regulations.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 1096 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 1096, Annual Summary and Transmittal of U.S. Information Returns |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 46 |

| Number of pages: | 3 |

| Version: | 2024 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-1096 |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f1096.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 1096 Online for Free in 2025

Are you looking to fill out a 1096 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your 1096 form in just 37 seconds or less.

Follow these steps to fill out your 1096 form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 1096.

- 2 Enter your name and address details.

- 3 Provide your TIN in the appropriate box.

- 4 Indicate the total number of forms being filed.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 1096 Form?

Speed

Complete your Form 1096 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 1096 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 1096

Form 1096 is used to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS.

No, you should not print and file a Form 1096 downloaded from the IRS website as it is not scannable and may result in a penalty.

To order official IRS information returns, which include a scannable Form 1096, visit www.IRS.gov/orderforms.

Yes, information returns can be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system or the IRS Affordable Care Act Information Returns (AIR) program.

Any person or entity who files any form checked in box 6 of Form 1096 must file Form 1096 to transmit those forms to the IRS.

Form 1096 is due by February 28 for most forms, by January 31 for Forms 1099-NEC, and by May 31 for Forms 5498, in the calendar year following the year for which the information is being reported.

The mailing address for Form 1096 depends on the location of your principal business, office, agency, or legal residence. Specific addresses are provided in the form instructions based on these locations.

For information about filing corrections, refer to the General Instructions for Certain Information Returns for the relevant tax year.

Enter your Employer Identification Number (EIN) in box 1 or your Social Security Number (SSN) in box 2, not both. Sole proprietors without an EIN must enter their SSN in box 2.

In box 5, enter the total of the amounts from the specific boxes identified for each form being transmitted, except if you are filing Form 1098-T, 1099-A, or 1099-G, in which case no entry is required.

Compliance Form 1096

Validation Checks by Instafill.ai

1

Filer's Information Completeness

Ensures that the filer's name, address, city, state, country, and ZIP or foreign postal code are accurately entered. This information is crucial for the IRS to identify the filer and for any necessary correspondence. The system checks for completeness and proper formatting of all address components.

2

Contact Information Accuracy

Verifies that the contact person's name, telephone number, email address, and fax number are provided and correctly formatted. This information is essential for the IRS to reach out to the filer if there are any questions or issues with the submitted forms.

3

Taxpayer Identification Numbers Validation

Confirms that the Employer Identification Number (EIN) or Social Security Number (SSN) is provided as applicable. The system checks for the correct number of digits and the validity of the provided TIN against IRS records to prevent filing errors.

4

Form Totals Calculation

Calculates and verifies the total number of forms being transmitted, the total federal income tax withheld, and the total amount reported. The system ensures that these totals are accurate and correspond to the attached forms to avoid discrepancies.

5

Type of Form Being Filed Selection

Ensures that an 'X' is marked in only one box in box 6 to indicate the type of form being filed. The system checks for a single selection to prevent confusion and ensure that the IRS can process the forms correctly.

6

Signature Presence

Confirms that the form has been signed and dated by the filer. The system checks for the presence of a signature and date to ensure the form is legally binding and has been reviewed by the filer.

7

Signer's Title Verification

Verifies that the title of the signer is included next to the signature. This check is important to confirm the authority of the individual signing the form.

8

Correct Filing Address

Determines the correct IRS filing address based on the filer's principal business, office, agency, or legal residence. The system uses the provided state or territory to find the appropriate address to prevent misrouting.

9

Filing Deadlines Adherence

Checks the submission date against the relevant filing deadlines for the specific forms being filed. This validation is crucial to avoid penalties for late submissions.

10

Electronic Filing Eligibility

Assesses whether electronic filing is applicable and guides the filer towards the IRS FIRE system or AIR program if eligible. This check encourages filers to use more efficient and secure filing methods.

11

Form Stapling Prevention

Ensures that no part of the form is stapled, as this could interfere with IRS processing equipment. The system alerts the filer if it detects any indication of stapling.

12

Official IRS Form Usage

Confirms that the filer is using an official IRS form rather than a printed copy from the website, which may not be scannable. This check is important to prevent penalties associated with non-scannable forms.

13

Summary Information Exclusion

Verifies that no summary or subtotal information is included with Form 1096, as this could lead to processing errors. The system checks for and flags any additional totals or summaries.

14

Corrected Returns Handling

Ensures that originals and corrections of the same type of return are submitted using one Form 1096. This check simplifies the filing process for corrected returns.

15

Name and TIN Consistency

Checks that the name and TIN on Form 1096 match those used on the filer's 94X series tax return(s). This validation is essential for maintaining consistency across tax documents and avoiding mismatch penalties.

Common Mistakes in Completing Form 1096

Filers often forget to include their complete name, address, and contact information, or they provide incorrect details. To avoid this mistake, double-check the filer's information for accuracy before submission. Ensure that the street address, including room or suite number, city, state, and ZIP code are all correctly entered. Additionally, provide a valid contact name, telephone number, email address, and fax number for potential IRS inquiries.

A common error is entering the Employer Identification Number (EIN) in the Social Security Number (SSN) box, or vice versa. To prevent this, carefully enter the EIN in box 1 only if it is applicable to your situation, and the SSN in box 2 if that is the identifier you use. Do not fill both boxes unless both numbers are legitimately used in your tax documents.

Filers sometimes report incorrect totals in boxes 3, 4, and 5. It is crucial to accurately tally the number of forms, the total federal income tax withheld, and the total amount reported. To avoid errors, use a calculator to sum up the totals and cross-verify the amounts with the individual forms being transmitted with Form 1096.

One of the frequent mistakes is marking more than one type of form in box 6. Ensure that you mark an 'X' in only one box that corresponds to the type of form you are filing. If you are filing multiple types of forms, you must use a separate Form 1096 for each form type.

Forgetting to sign and date the form is a common oversight. The IRS requires that Form 1096 be signed and dated by the filer. Remember to include the title of the person signing the form. Unsigned or undated forms may be considered invalid and can lead to processing delays or penalties.

Sending Form 1096 to the wrong IRS address can result in processing delays. The correct filing address depends on your principal business location. Refer to the IRS-provided addresses in the form instructions and ensure you send your forms to the appropriate address for your state or territory.

Filers sometimes miss the filing deadlines for the different types of forms. To avoid penalties, file Form 1096 with the appropriate forms by the specified deadlines. For most forms, the deadline is February 28, for Form 1099-NEC it's January 31, and for Form 5498, it's May 31 of the year following the reporting year.

Not considering electronic filing can be a missed opportunity for a more efficient process. Electronic filing through the IRS FIRE or AIR systems can be faster and more secure. Review the electronic filing options and consider using them to submit your information returns.

Stapling any part of Form 1096 or using photocopies can cause issues during processing. Use only official IRS forms and do not staple them. Ensure that all forms are free of staples and other attachments before mailing.

A mismatch between the name and TIN on Form 1096 and the 94X series tax returns can lead to processing errors. Verify that the name and TIN on Form 1096 exactly match those used on your tax returns to prevent any discrepancies and potential penalties.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 1096, Annual Summary and Transmittal of U.S. Information Returns with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 1096 forms, ensuring each field is accurate.